Providing Capital for Future Generations

As noted in the Winter edition of the RAN, Regis will receive this spring the remaining half of a gift of $10.2 million from the estate of Hugh Grant, Jr., son of the Foundress. This final gift from the family will bring the total balance of the Regis endowment to $84 million.

As noted in the Winter edition of the RAN, Regis will receive this spring the remaining half of a gift of $10.2 million from the estate of Hugh Grant, Jr., son of the Foundress. This final gift from the family will bring the total balance of the Regis endowment to $84 million.

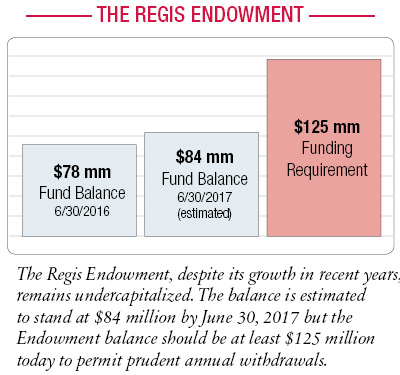

This is good news indeed. But it is important to remember that Regis, as a tuition-free institution, remains undercapitalized. Withdrawals from the endowment each year are combined with income from Annual Giving to meet the school’s $14 million operating budget. There have been many years where we incurred endowment withdrawals in excess of what is actuarially prudent, depleting the school’s capital base.

To permit a sustainable level of annual withdrawals, and provide capital funds for future needs, the Regis endowment today should total at least $125 million. Bequests and other forms of Planned Giving will play a crucial role in helping the school reach that goal.

The Office of Development can help you and your professional advisors explore the best ways to gift your assets and determine which gift plan is right for you and your family. You may call us on 212-288-1142, e-mail us at giving@regis.org, or visit us at regisgift.org. Thank you for all you do for Regis.

A Bequest

In your will there are a number of ways to make a bequest and qualify your estate for a tax deduction:

- Make a specific bequest of cash, securities or other property to Regis, or a specify a fixed percentage of your estate

- Leave all or a portion of your residuary estate to Regis after you have provided for other beneficiaries

- Name Regis as a contingent beneficiary of estate in the event other beneficiaries do not survive you

A Gift from a Retirement Plan

Even if an estate is not subject to estate tax, assets in IRA’s and 401-K plans that were funded with pre-tax dollars are subject to income tax if left to heirs. If estate taxes do apply, as much as 70% of an inherited IRA may be consumed by estate and income taxes. Gifting all or part of these retirement assets will benefit Regis and provide important tax benefits:

- You will avoid any potential estate tax on your retirement plan assets

- You will permit your heirs to avoid income tax on retirement assets funded on a pre-tax basis

- If you are liable for estate tax you can receive potential tax savings from an estate tax deduction

You can make Regis a beneficiary of your retirement plan without re-drafting your will. You need only complete a beneficiary designation form provided by your plan custodian.

A Gift of Life Insurance

Regis as Beneficiary: When you name Regis as the beneficiary to receive the face value of a policy upon your death, your estate may receive a charitable deduction.

Regis as Owner: You can make Regis the owner and irrevocable beneficiary of an existing life insurance policy. You will receive a tax deduction for the gift of the policy based on its replacement or cash surrender value. If you continue to pay premiums after gifting the policy, in order to keep it in force, you may deduct from taxable income the amount of the annual premium.

Read more Regis news